Your investment portfolio shouldn’t look the same once you have retired.

Your retirement investment portfolio should look different to the portfolio you had before you retired, as you will be withdrawing money from it on a regular basis. But how should it be different?

In this post, I have set out the basic principles for the construction of retirement income portfolios.

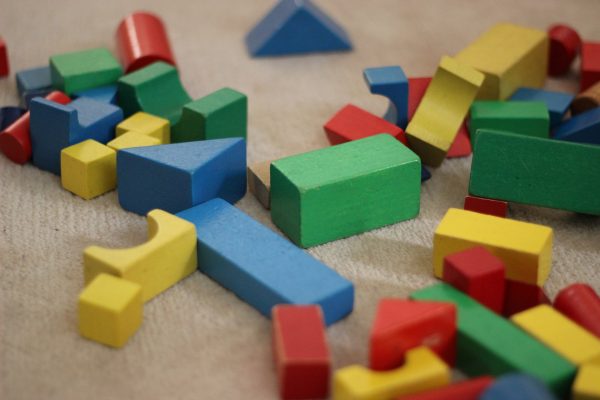

There is only a limited number of investments available to any investor, so the building blocks of your retirement portfolio will be the same as for any other investment portfolio:

- shares

- fixed interest stock (loans to companies and governments),

- property,

- cash,

- and, maybe, some alternative investments, like gold.

However, the mixture of those building blocks will depend on

- how much you need to withdraw (as a percentage of your capital),

- your life expectancy,

- the extent to which you can afford to reduce the withdrawals from your portfolio in difficult periods,

- when you started making withdrawals from your portfolio (and what has happened since then)

- and your risk personality.

This second list is quite different to the factors which would shape a growth portfolio, and, as a result, no two people’s retirement portfolios will look the same.

This drives our fundamental view that, whilst we may use the same process to build portfolios for each of our clients, each portfolio will be different. It may be inconvenient but the fact is that any standardised portfolio will be second rate and could jeopardise your financial security.

If you would like to find out more about us and how we can work together to create a bespoke retirement income plan, please get in touch.

Philip Wise | philip@sussexretirement.co.uk

Managing Director and Chartered Financial Planner